How to Acquire a Tesla Almost for Free

Dreaming of cruising in a Tesla without breaking the bank? Buckle up as we unveil a revolutionary approach that allows you to acquire a Tesla almost for free. In this article, we’ll delve into the innovative Cash Flow Acquisition Model, providing you with actionable steps to make luxury an affordable reality.

The Strategic Path to Affording Luxury: A Personal Finance Model

- Financial prudence is often seen as a virtue, but it can sometimes mask an underlying anxiety about financial security;

- The challenge is to strike a balance between saving and enjoying the rewards of one’s hard work;

- That balance was achieved through the adoption of an investment strategy known as “The Cash Flow Acquisition Model.”;

- This approach was recently applied to effectively reduce the cost of acquiring a high-value vehicle, specifically a Tesla Model S valued at over $100,000.

Key Insight: Instead of depleting savings to acquire luxury items, the chosen strategy involves allocating funds into investments that generate sufficient income to cover the expenses of these high-end purchases.

The beauty of this model is twofold: it preserves the initial capital, allowing it to continue growing and contributing to net worth, while the generated income from these investments gradually offsets the cost of the luxury item. At the end of the payment period, there’s the dual benefit of retaining the original investment and also owning the asset outright.

A Smart Approach to Financing High-Value Purchases

Consider a scenario where a high-value asset, such as a premium electric car with a price tag of around $100,000, is desired. The typical monthly financing for such an asset hovers around $1,400. While the straightforward option might be to purchase it outright with cash, an alternative approach leverages strategic financial planning.

Instead of using cash reserves for the purchase, the funds can be diversified into a robust investment portfolio, potentially yielding a return rate of approximately 15% per annum. This rate of return is not fixed and can vary based on the chosen investment risk level.

The annual return generated from this investment portfolio is projected to range from $15,000 to $20,000, effectively covering the asset’s financing costs. Additionally, the potential appreciation in the investment’s value could result in an increase in net worth, notwithstanding the inherent risks and possible market fluctuations. You might be interested in: Crafting Your Identity: The Influence of Your Social Circle.

The long-term benefit of this strategy is evident after six years: ownership of the asset, preservation of the initial capital, and the establishment of a continuing revenue stream.

An important clarification is that the term « investment » here refers strictly to assets that generate cash flow, not necessarily those that appreciate in value. While an increase in value is a welcome bonus, the primary goal is to create a consistent income. Even in the event of a depreciation in the investment’s value, this strategy could still prove more advantageous than an outright cash purchase. For instance, purchasing real estate that yields a monthly rental income equivalent to the asset’s financing cost could provide both an income stream and partial net worth retention, even if the property’s market value decreases by a significant margin.

Halving Your Expenditures: A Strategic Business Approach

Imagine reducing the effective cost of an expensive asset by nearly half through savvy business accounting. This is possible by purchasing the asset under a company’s name, which can offer substantial tax deductions.

When an asset is acquired through a company, and the expense is legitimately claimed, it can result in significant tax savings. For instance, an expense that could potentially lead to around $45,000 in tax payments to the government might instead be directed towards the company’s operational costs.

A note of caution: tax laws are complex and can vary widely, so it’s essential to consult a tax professional or accountant before making such decisions.

Taking into account the tax deductions, the actual monthly cash flow required to finance the asset could be considerably reduced. Additional incentives, such as tax credits for environmentally friendly purchases like electric vehicles, can further decrease the out-of-pocket expenses.

With these adjusted figures, an investment return of about 8% annually could suffice to cover the costs, which is a more attainable target for many investors. More details on achieving these returns can be found in specialized financial training programs.

So, where can one find investments with a reliable 8-15% return? Opportunities abound in various sectors. Real estate, Real Estate Investment Trusts (REITs), and peer-to-peer lending platforms are some popular options.

Yet, the most lucrative investments are often those in businesses where the investor has direct influence and expertise. For example, investing in businesses within a familiar industry can yield returns far exceeding the standard percentage, given the investor’s ability to directly enhance the business’s performance.

It’s less commonly known, but consulting for companies that invest in online businesses can be particularly profitable. Providing expertise that increases the profitability of these businesses can lead to returns that substantially outpace the market average. The key is investing in areas where one can exert a direct influence, as this can potentially lead to uncapped returns on investment.

The Strategic Use of Debt in Wealth Building

The financial guidance of Robert Kiyosaki draws a distinction between ‘good debt’ and ‘bad debt,’ an initially perplexing concept that becomes clearer with the understanding that debt can be a tool for wealth creation. The key lies in leveraging cash to acquire debt that works for you, generating returns at a higher rate than the debt’s cost.

For example, if one could secure debt at a 1.99% interest rate and invest that amount to yield returns higher than 2%, this debt would be classified as ‘good debt,’ a type that is strategic and growth-oriented.

It’s a strategy akin to those used by real estate moguls to amass wealth, utilizing low-cost debt to finance high-return projects.

Creating a Lifetime of Financial Independence

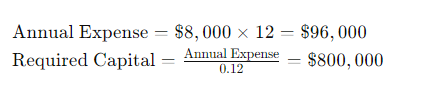

To achieve financial independence, one must establish a passive income stream that covers their monthly expenses. If living expenses total around $8,000 per month, the goal is to generate a matching passive cash flow.

A conservative financial target is to aim for a return of 1% per month, translating to about 12-14% annually. This is attainable through niche investments or by directing funds into a business where one can directly influence outcomes and growth.

To break down the math, if one requires $8,000 monthly and can secure a 12% annual return, then a net worth of approximately $800,000 is needed to retire comfortably.

Thus, with a goal of $8,000 monthly expenditures and a reliable 12% return on investment, a capital of $800,000 is the target for retirement.

The roadmap to accumulating such capital, and the strategies to do so, are subjects for more in-depth financial discussions and learning, such as through dedicated video series or educational resources.

Conclusion

Acquiring a Tesla almost for free is not a fantasy; it’s a strategic choice. The Cash Flow Acquisition Model is your roadmap to turn dreams into reality without compromising your financial well-being. Stay tuned for practical insights in video two, where we’ll guide you on generating the net worth required for a life of abundance and fulfillment. Share this article with fellow dreamers and enthusiasts ready to make luxury a part of their everyday journey!